About PLUS ES

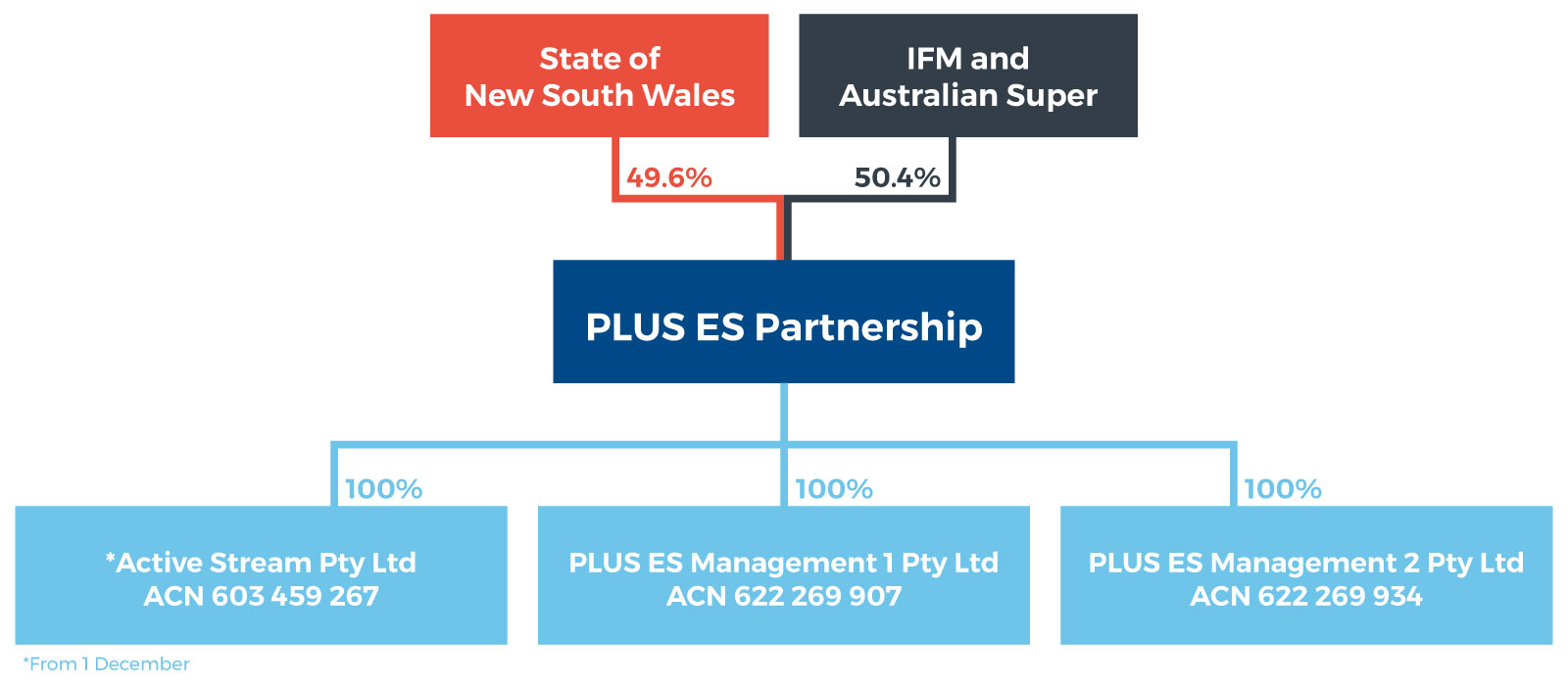

Marking a new era in emerging energy solutions, the PLUS ES brand was launched in late 2017. It represents a partnership between NSW Government and a consortium made up of IFM Investors and AustralianSuper. IFM Investors and AustralianSuper hold a combined 50.4% interest in PLUS ES.

IFM Investors

IFM Investors is an Australian-owned and headquartered, global fund manager with approximately A$86 billion under management across infrastructure, listed equities, private capital and debt investments. Owned by 28 Australian not-for-profit pension funds, IFM Investors has offices in Sydney, Melbourne, London, New York, Tokyo, Hong Kong and Berlin. The firm employs more than 320 staff and invests on behalf of the retirement interests of millions of working Australians.

IFM Investors is one of the world’s largest owners and managers of nationally critical infrastructure assets. IFM Investors manages over A$53.3 billion of direct infrastructure investments and manages two open-ended (evergreen) infrastructure funds, the IFM Australian Infrastructure Fund and the IFM Global Infrastructure Fund, as well as funds on behalf of clients. IFM Investors has significant interests in 30 assets in Australia, North America and Europe across a range of infrastructure sectors including energy utilities, airports, seaports, toll roads and electricity generation.

Key investments in Australia include: Ausgrid (25.2%), Port Botany and Port Kembla (35%), InterLink Roads (M5) (15%) and Eastern Distributor (M1) (14%), Melbourne Airport (24%), Brisbane Airport (19%), Port of Brisbane (27%) and Southern Cross Station (100%).

IFM Investors also has significant experience in the regulated and energy infrastructure sector gained through its investments in 50Hertz Transmission (40%, Germany), Veolia Energia Polska (40%, Poland) and Anglian Water Group (20%, UK).

AustralianSuper

AustralianSuper is a profit for member organisation and manages more than A$142 billion of members’ assets on behalf of more than 2.3 million members from across 285k businesses. One in ten working Australians is a member of AustralianSuper, the nation’s largest industry superannuation fund. AustralianSuper has been investing in productive infrastructure businesses and assets for over 20 years with a current infrastructure portfolio in excess of A$15 billion. AustralianSuper is one of Australia’s largest and most experienced infrastructure investors with holdings in many significant Australian assets, including direct shareholdings in Port Botany and Port Kembla (20%), Transurban Queensland (25%) and Perth Airport (10%).

Plus ES Group is a newly established group (the Group) under common ownership with Ausgrid. Plus ES Partnership is the head entity of the Group and is ultimately owned by IFM, Australian Super and the State of New South Wales. The State of New South Wales holds a 49.6% interest in the Plus ES Partnership and IFM and Australian Super jointly hold the remaining 50.4% interest in the Plus ES Partnership.

The Plus ES Partnership is a partnership carried on under that name by:

- Blue PES Partner Pty Ltd (ACN 622 175 428) as trustee for the Blue PES Partner Trust;

- ERIC Alpha AUP Corporation 1 Pty Ltd (ACN 621 524 374) as trustee for the ERIC Alpha AUP Trust 1;

- ERIC Alpha AUP Corporation 2 Pty Ltd (ACN 621 524 454) as trustee for the ERIC Alpha AUP Trust 2;

- ERIC Alpha AUP Corporation 3 Pty Ltd (ACN 621 524 525) as trustee for the ERIC Alpha AUP Trust 3; and

- ERIC Alpha AUP Corporation 4 Pty Ltd (ACN 621 524 605) as trustee for the ERIC Alpha AUP Trust 4.

The Plus ES Partnership currently has two wholly owned subsidiaries;

- Plus ES Management 1 Pty Ltd (ACN 622 269 907); and

- Plus ES Management 2 Pty Ltd (ACN 622 269 934),

each a PES Subsidiary and together the PES Subsidiaries.

The PES Subsidiaries will employ all employees in the Group and provide agency and employment services to the Plus ES Partnership and other Group entities.

On completion of the acquisition of Active Stream Pty Ltd (expected to occur on 30 November 2017, effective 1 December 2017, subject to the satisfaction of the conditions precedent to the acquisition) Active Stream Pty Ltd will be a wholly owned subsidiary of the Plus ES Partnership.

A diagram setting out the Group structure is set out below.